Colombia's Relationship with the PRC

Overview

From October 6 to 16, the author traveled throughout Colombia to speak with businesspeople, academics, and other professionals about the country’s security panorama, its commercial and other relationships with the People’s Republic of China (PRC), and prospects for evolving those relationships under the new government of Gustavo Petro. This white paper, the first of two on those interactions, addresses the country’s important and deepening relationship with the PRC and its companies.

In recent years, Colombia’s political and security relationship with the PRC has been limited. This arguably reflects Bogotá’s perception that deepening political and security ties with the PRC might damage its close and important relationship with the United States. Nonetheless, despite perceptions that the PRC is more of a threat than an opportunity in the commercial arena, the presence of Chinese companies and their representatives in the country has expanded remarkably. Under the Petro government, all dimensions of Colombia’s relationship with the PRC, from political and security affairs to economic ones, are poised to expand and shift in ways that may cause unease in Washington.

Under the Petro government, all dimensions of Colombia’s relationship with the PRC, from political and security affairs to economic ones, are poised to expand and shift in ways that may cause unease in Washington.

Politics

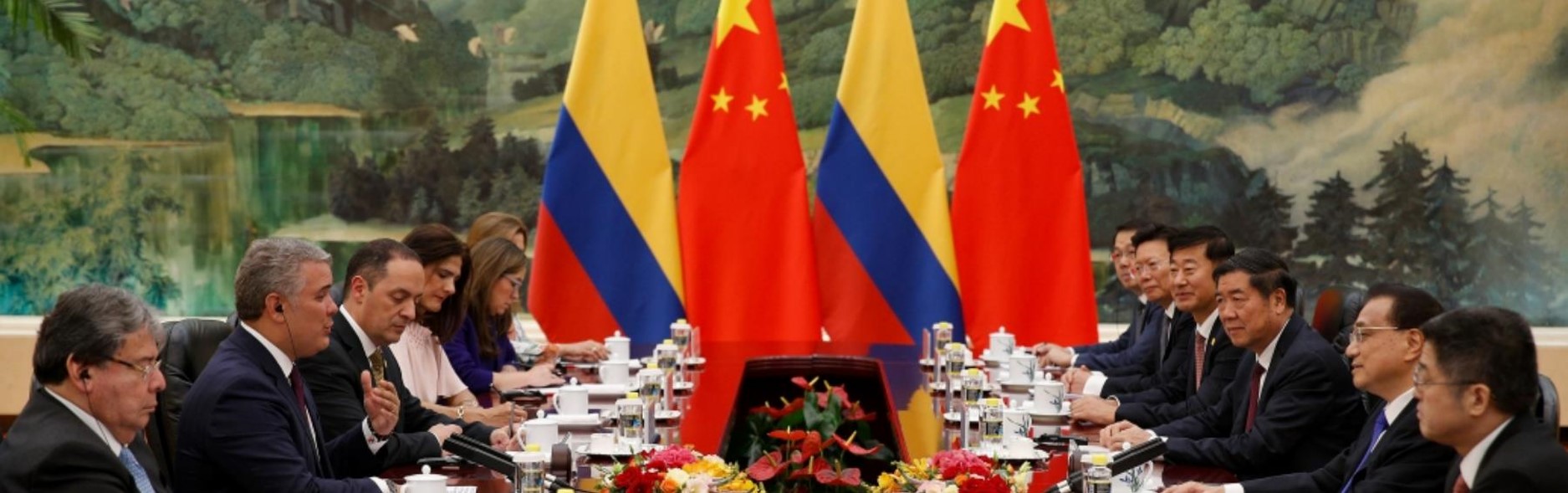

Colombia’s political relationship with the PRC is one of the most long-standing in the region. In 1980 Colombia switched its diplomatic recognition from the Republic of China (ROC-Taiwan) to the PRC. More recently, recognizing the PRC’s increasing commercial and strategic importance, conservative and centrist Colombian presidents have traveled to the PRC, including Álvaro Uribe in 2005, Juan Manuel Santos in March 2012, and Iván Duque in July 2019.

At the same time, prior Colombian governments have avoided associating themselves with key symbolic vehicles that demonstrate deepening commitment to China. Colombia has not, to date, joined China’s Belt and Road Initiative (BRI), though 21 countries in Latin America and the Caribbean have. Nor has the PRC conferred on Colombia the status of “strategic partner,” as it has with 10 countries in the region.

Petro, who took office in August 2022, has not focused extensively on the PRC in his left-oriented public discourse, though he has taken actions that suggest the relationship could deepen both directly and indirectly. First, he appointed Sergio Cabrera as Colombia’s ambassador to the PRC. Cabrera, a well-known film director, was seemingly an unusual choice, though he grew up in China with Communist parents during the revolutionary era of Mao Zedong and attended Beijing University, the most respected institution for higher education in the PRC. Cabrera returned to Colombia to participate in the People’s Liberation Army (PLA) guerilla movement before returning to the PRC and starting his film career. His access to many parts of China while filming suggests the high level of trust the Chinese have in him.

President Petro’s foreign minister, Álvaro Leyva, has a history of focusing more on peace negotiations with leftist terrorist groups such as the Revolutionary Armed Forces of Colombia (FARC) than on the PRC. However, he reportedly has strong left-oriented ideological commitments that may dispose him to deepening the Colombia-PRC relationship, following the lead of President Petro. Both China-oriented colleagues and others noted much discussion about a presidential-level engagement and Colombia joining the BRI.

The PRC sent Lan Hu as ambassador to Colombia in January 2020. Hu is a senior diplomat with significant experience in Latin American affairs, serving as deputy chief of mission in Venezuela from 2011 to 2015 and briefly acting as ambassador before returning to the PRC as the deputy head of the Latin American division of the foreign ministry. Colombians who have interacted with him note he has an excellent command of Spanish and is a skillful diplomat. Although Covid-19 protocols in the PRC have limited his public engagement, and he is less known in business and social circles than Chinese ambassadors in other Latin American countries, he reportedly is very active, in a low-key fashion, in the affairs of Chinese businesses and the Chinese community. The PRC has indicated its support for the Petro administration’s new direction, endorsing steps toward seeking a peace deal with the National Liberation Army (ELN).

Commerce

Bilateral commerce between the PRC and Colombia expanded 35-fold between 2001, when the PRC was accepted into the World Trade Organization, and 2014. Since then, growth has leveled off and has been subject to substantial variation. Like many countries in Latin America, Colombia has consistently run a trade deficit with the PRC. According to data from the International Monetary Fund, Colombia’s exports to the PRC expanded from $27.10 million in 2002 to a maximum of $5.76 billion in 2014 to $2.75 billion in 2020. At the same time, imports from the PRC expanded from $516 million in 2002 to a height of $11.79 billion in 2014, then falling and leveling out to $10.40 billion in 2020. Colombia’s imports are almost four times its exports to the PRC.

Although Colombia sells a limited quantity of brand-name luxury goods and other specialty products to the PRC—consistent with most of its Latin American neighbors—its primary exports to the PRC by value are commodities, including petroleum, coal, and iron. Colombia imports a much broader range of high-value-added consumer and intermediate goods from the PRC. Traditional Colombian industries have struggled to adapt to challenge from the PRC. The Colombian textile industry was particularly hard hit by competition from China following the end of the Multifiber Arrangement in 2005, though Colombian producers have adapted, in part, by incorporating Chinese and other less expensive inputs into their value chains.

Investment

As a complement to trade, investment from and projects involving PRC-based companies in Colombia have expanded significantly in the past decade. Colombia experienced particularly impressive growth as it recovered from the Covid-19 pandemic. As of 2022, there were at least 100 PRC-based companies operating in Colombia, including 38 active investment projects totaling $2.04 billion. This presence spans a broad range of sectors, from petroleum and mining to infrastructure, telecommunications, and digital industries.

Activities by PRC-based companies were a central topic among the Colombian businesspeople interviewed, from those working with them to those who have had negative experiences with them or see them as competitors.

Petroleum

PRC-based companies have long played an important, if limited and low-profile, role in the petroleum sector. In 2006 the Chinese company Sinopec and the India-based Oil and Natural Gas Corporation (ONGC) acquired a Canadian firm operating in the country to establish Omimex. In 2009 the PRC-based firm Sinochem acquired Emerald Energy, with significant petroleum operations in the guerilla-dominated Magdalena Medio region, among others. Emerald was victimized by threats from and problems with illegal armed groups in the areas where it was extracting petroleum, including the June 2011 kidnapping of three of its petroleum workers.

The China National Offshore Oil Corporation (CNOOC) also entered Colombia in July 2012 with the $15.1 billion acquisition of the Canadian petroleum firm Nexxen. Petroleum service firms such as Kerui have also followed larger PRC-based firms into the country, though their ability to win work with non-Chinese firms has reportedly been limited. On the Colombian side, Ecopetrol has been very effective in establishing good relationships with refineries in China to place Colombian crude exports.

Mining

The PRC has an important role both as a purchaser of Colombian coal and nickel exports and as an operator of the Buriticá gold mine since 2020. The Chinese mining company Zijin acquired the Buriticá gold mine in Antioquia in December 2019 from the Canadian firm Continental Gold for $900 million. The transaction was finalized in March 2020, making Zijin a major employer and actor in a region beset by problems with illegal and other informal mining and armed groups, as well as difficult relations between the mine and the labor force and surrounding community, which had challenged Continental Gold.

Since it took over the mine, Zijin has had multiple difficulties with the labor force and surrounding community. These include protests in March 2020 over whether the company’s operations during the Covid-19 pandemic were consistent with national regulations and put workers at risk. Another round of protests in October 2021 became violent, forcing Colombian authorities to deploy the national riot police (ESMAD). Further protests occurred in February 2022 over the mine’s impact on the local water supply and in August and September 2022 over the disappearance of two informal miners.

The Petro government has not yet addressed China’s presence in the mining sector, as it has in the petroleum sector, making it a complex issue on both sides. The Petro administration indicated in its campaign a desire to phase out the Chinese demand and presence in the mining sector, sparking discontent among labor and community groups important to the president’s coalition. The president may wish to manage the situation cautiously so as not to jeopardize revenue from Colombian exports to the PRC or PRC investment in the country more broadly.

Agriculture

China’s engagement in the Colombian agricultural sector has been limited, but there is significant interest among PRC-based and Colombian firms. For example, Colombian coffee producers have exported some coffee to the PRC, often through third-party purchasers such as Starbucks. But exporters hope to increase Colombian penetration of the PRC market, which has grown in potential as select demographics within the traditionally tea-consuming Chinese market have developed a taste for coffee. Nonetheless, far closer suppliers in Asia continue to put the Colombians at a cost disadvantage.

Colombian firms have made progress in other sectors as well, such as in the 2022 certification to export Colombian avocados to the PRC. With respect to PRC investment in Colombian agriculture, delegations of Chinese firms have explored acquisition of land for export-based agriculture over the past decade. Yet the combination of insecurity in the Colombian interior, the lack of cost- and time-efficient transportation options, and sensitivity among some Colombians over Chinese acquisition of land have inhibited development of such projects.

Transportation Infrastructure

Infrastructure projects have arguably been the most significant and highest-visibility area of the PRC’s expanding presence in Colombia, though major problems have beset many of those activities. For years, Chinese attempts to secure infrastructure projects in Colombia were characterized by false starts. Arguably, the most prominent was in 2011 following discussions under President Santos to contract PRC-based companies to build a “dry canal” connecting the Atlantic and Pacific coasts. In 2017 the Chinese company PowerChina, with multiple industrial groupings from electricity generation to hydroelectric facilities, sought to win a contract to dredge and increase the navigability of the Magdalena River, one of Colombia’s key river corridors. The contract was derailed, however, by allegations of bribery involving the principal company competing, Brazil-based Odebrecht.

Infrastructure projects have arguably been the most significant and highest-visibility area of the PRC’s expanding presence in Colombia, though major problems have beset many of those activities.

In 2014 the PRC-based China Harbour Engineering Company (CHEC) won a $652 million contract, in partnership with two Colombia-based companies, to build and improve the 254-kilometer Mar 2 Road from Medellín to Necoclí in the Gulf of Urabá. The project was one of several fourth-generation (4G) highway contracts for which the Colombian government was soliciting bids under a public-private partnership (PPP) approach, in which the contractor provides some of its own financing. Mar 2 Road was the first PPP contract won by a PRC-based company in Colombia. The project leveraged internal financing from China Development Bank through Goldman Sachs, as well as from Japan’s Sumitomo Mitsui Bank.

After winning the contract, CHEC and the two Colombian companies it partnered with split up the work. From the beginning, CHEC ran into problems, including bringing in an excessive number of Chinese laborers to work on the project. This ultimately obligated the Colombian state to restrict the number of work visas it gave to CHEC, forcing the Chinese firm to subcontract out some of its work. CHEC also experienced problems regarding the quality and schedule of the bridges and tunnels under its responsibility. Despite such problems, according to infrastructure experts interviewed for this work, by late 2022, the project was approximately 92 percent complete.

In Bogotá, CHEC leveraged the experience and foothold it gained through its work in Antioquia to join forces with Xi’an Metro to begin work on line one of the Bogotá Metro. The project was awarded to the consortium in October 2019. As another PPP project, it was financed 70 percent by the Colombian government and 30 percent by PRC banks. Although the Covid-19 pandemic delayed the start of the project for two months, work began in August 2021. As of October 2022, work was being done on the metro stations, with physical construction of the lines expected to be completed between 2023 and 2026. The decision to construct line one of the metro principally above ground was largely shaped during the administration of Bogotá mayor Enrique Peñalosa. Petro, during his time as mayor of Bogotá, fought for the more expensive option of locating the metro underground. During his campaign for the presidency, he suggested he would renegotiate the contract with the Chinese to build the metro below ground, though upon assuming office, he was convinced by advisers that such a renegotiation, with substantial commitments already made, would be counterproductive. Line two of the metro, however, which is to extend from the north of Bogotá to the northwest suburbs, may be constructed underground per President Petro’s preferences.

Building on the Bogotá metro project, a different Chinese company, China Civil Engineering Construction Corporation (CCECC), won a contract in 2019 to build the RegioTram light rail system in the department of Cundinamarca, a 17-station train line that will connect Bogotá with surrounding cities. The victory raised some questions because it was the only bid presented.

On October 2022, the PRC-based conglomerate China Railway Road Corporation (CRRC), in partnership with Mota-Engil—30 percent owned by China Communications Construction Corporation (CCCC)—received a $3.5 billion public-private contract to build a metro across the eastern side of Medellín in Antioquia. The Colombian contracting organization, Metro de Medellín, is a public company 70 percent owned by the city of Medellín and 30 percent by the national government. Previously, it had worked with Chinese entities on a smaller scale, including purchasing electric vehicle maker BYD electric buses. Although four groups were initially interested in the project, including those based in France, Germany, and Spain, as with the RegioTram, the Chinese ultimately secured the contract as the only remaining bidder.

In the port sector, Chinese firms are beginning to make progress as well. The PRC-based firm Zhenhua Heavy Industries Company Limited (ZPMC) has supplied cranes for port operations in Cartagena and Santa Marta on the Atlantic coast. Although Chinese companies have long been unsuccessful in winning work to expand or manage parts of Colombia’s principal Pacific coast port of Buenaventura, Chinese interests are reportedly vying to construct a liquid natural gas regasification facility there. In September 2022, a group of Chinese investors visited Buenaventura, possibly to talk about the deal. Chinese investors have also sought projects in the port of Tribugá and the bay of Málaga, as well as an expansion of the port of Tumaco. The latter is of particular value as a binational port due to its position near the frontier with Ecuador. However, the opportunity is diminished by criminal groups’ domination of the zone.

In the aviation sector, the PRC-based consortium Capital Airport Holding Company (CAH) acquired a controlling share of the AirPlan consortium to manage and modernize Medellín’s principal airport, in Rionegro, and five surrounding airports in Antioquia. AirPlan also reportedly began operating Medellín’s Carepa airport in 2008.

In Bogotá, according to experts interviewed for this work, CHEC is moving beyond its work on Mar 2 and the Bogotá Metro to position itself to bid on the next phase of the expansion of the capital’s principal international airport, El Dorado.

Electricity

In electricity, as in other sectors, PRC-based companies have overcome substantial clumsiness to expand their position. The earliest serious attempt by a PRC-based firm to win work in the sector was by Sinohydro, a subsidiary of the PRC-based giant PowerChina. In 2010 Sinohydro participated in but failed to win a contract from the Antioquia public infrastructure organization Empresas Públicas to build the hydroelectric facility Hidroituango.

In 2014 a consortium of China United Engineering Corporation (CUC), an affiliate of China National Machinery Industry Corporation (Sinomach), and Sinomach won a contract to build the low-energy coal thermoelectric plant Gecelca in Montelíbano and Puerto Libertador in Córdoba. The work began in 2015 but experienced numerous delays, including withdrawal from the project by two different Colombian subcontractors, leading to legal disputes over nonpayment, among other issues. Nonetheless, Gecelca finally entered into service in 2018, supplied by the Las Palmeras coal mine. It is unclear if Geselca, which uses a carbon-based source for electricity production but is cleaner than traditional coal-fired power plants, will be a target for the Petro administration to phase out as part of its stated intention to decarbonize the Colombian economy.

In Hidroituango, when construction defects led to the near collapse of the dam in 2016, Medellín’s new left-of-center mayor Daniel Quintero fought to take the contract away from the consortium and rebid its completion to a different party. In March 2022, Empresas Públicas released a public tender to complete the project. Yellow River, a relatively unknown Chinese consortium, has presented the only bid. PowerChina, the parent of Sinohydro, which competed for the original project in 2016, reportedly helped prepare the bid. Some of the people interviewed in Antioquia suspected collusion between Medellín’s mayor and the Chinese to secure the project.

PowerChina is pursuing numerous other projects beyond Hidroituango throughout the country, including smaller hydroelectric facilities in Chocó and Risaralda, solar (photovoltaic) and wind projects with PRC-based partners Trina Solar, China Three Gorges Corporation (CTG), and Yingli Solar. Trina Solar, with PowerChina’s support, is in the process of building the 19.9-megawatt Urra Solar PV Park in Córdoba. PowerChina has also installed solar panels in a hospital. The other Chinese firms are reportedly in the process of looking for business opportunities in the sector. Given the environmentalist orientation of the Petro government, such hydroelectric, wind, and solar projects promise to provide significant growth areas for the Chinese in the coming years.

Vehicle Sales and Assembly

Numerous PRC-based companies have entered the Colombian market in recent years in sectors such as motorcycles, cars, light trucks, buses, and construction equipment, usually in conjunction with local partners. The Chinese presence and the relationship with local partners has evolved significantly since the Chinese firm Jialing set up a motorcycle assembly facility in Cali in 1997 and the firm Jincheng set up a small assembly facility in Barranquilla in 1998.

With respect to motorcycles, through Colombia’s Grupo Corbetta, the Chinese-made motorcycle brand AKT has come to dominate the national market, helped by competitive prices and relatively easy-to-obtain financing. The latter has made the motorcycles attractive to groups such as Venezuelan immigrants, who use motorcycles obtained on credit for money-earning ventures such as food delivery services.

In the automotive industry, major Chinese actors include Chery, Chang’an, FAW, JMC, JBC, Great Wall, Derco, Foton (affiliated with Grupo Corbetta), and electric vehicle maker BYD. Chinese companies have also sold a large number of buses to Colombian cities. The most significant is the sale of hundreds of busses to the Bogotá transportation system TransMilenio. Other bus sales have been made to municipal governments in Medellín and Cali. JMC has been the key vendor of electric busses, though Yutong has sold busses in Colombia as well.

With respect to heavy equipment, both the PRC-based state-owned enterprise Xuzhou Construction Machinery Group (XCMG) and the large, privately owned (but closely state-affiliated) company Sany have a presence in Colombia. As of October 2022, Sany was reportedly looking for sites in Colombia for a construction equipment assembly facility.

Retail Sector

The PRC’s presence in the Colombian retail sector has principally involved imports of goods made in the PRC to local or external firms. High-profile examples include San Andresito, a market for low-price retail goods in the greater Bogotá area, and El Hueco in Medellín. In the case of San Andresito, the San Victorino neighborhood where many of the retail activities took place, it became the source of protests and some violence in June 2015 and March and May 2016 because of the penetration of the market by Chinese owners, though the Chinese presence has since reportedly diminished. In El Hueco, by contrast, the families from the locality of Marinilla (the “Marinillos”), who dominate the business of importing goods from the PRC, have reportedly been successful in maintaining a monopoly on the business.

In Bogotá, Chinese business interests operating under the name JF Capital moved in 2021 to bail out and operate Justo y Bueno, a defunct low-price Colombian retail chain, but the deal fell apart over irregularities.

Technology

In digital and other technology sectors, PRC-based firms have made significant advances in Colombia in recent years. In telecommunications, the Chinese firm Huawei has operated in the Colombian market for at least 15 years and currently has a dominant position in the sale of telephones and other telecommunications devices to Colombian retailers such as Movistar and Claro. Huawei has also been a major provider of mobile hotspots in the country. It is also the key supplier of equipment and internet of things (IoT) architectures for 5G pilot projects undertaken by Movistar and Claro.

As a complement to its dominance in Colombia’s telecommunication device and commercial solutions market, as elsewhere in Latin America, Huawei is moving into cloud computing, one of its core new business areas. Its plans include establishing a data center in Antioquia. In addition, it has been a key partner for technology promotion efforts by Colombian local governments, including the Ruta N project, promoted by the previous national government, to support education and other programs to make Medellín into a technology innovation hub for the country. As an example of such initiatives, in July 2021 Huawei and Colombia’s National Training Service (SENA) launched an artificial intelligence learning laboratory in the city.

The Chinese telecommunications company ZTE also has a substantial presence in Colombia, though it focuses on infrastructure and devices such as routers and modems rather than phones. In the retail telecommunications sector, Chinese companies Xiaomi, Oppo, and Vivo are also present. Xiaomi, a competitor of Apple, arrived in the Colombian market in 2021, building a retail store in Parque La Colina.

The Chinese firm Alibaba also has an important presence in Colombia, although as with other parts of the region, it has been most successful in the business-to-business (B2B) arena rather than in the business-to-consumer (B2C) sector, where it faces significant competition from other actors such as Mercado Libre and Amazon. Alibaba has been one of the Chinese firms working with the Ruta N project in Medellín to provide technology training and other support.

In the banking sector, the absence of Chinese banks is notable, reflecting the historically closed nature of the Colombian banking sector. The Brazilian fintech firm Nubank, which is partially owned by China’s Alibaba, entered the Colombian market in 2020 and has established a limited presence there.

In the domain of digital surveillance, the PRC-based companies Hikvision and Dahua both operate in Colombia, though their success appears confined to selling security systems solutions to companies and individuals rather than more complex “safe city” or “smart city” solutions to Colombian municipalities.

As elsewhere in Latin America, the PRC-based rideshare company DiDi Chuxing (DiDi) made significant progress in Colombia as the country emerged from the Covid-19 pandemic. The market includes multiple other actors, including Uber and Cabify, though rideshare services are generally illegal in the country. DiDi entered the Colombian market in 2019 and as of 2022 had approximately 30 percent of the market. Techniques the company has used to expand its market share have included offering more flexibility for drivers, allowing users to hire conventional taxis and private vehicles, and venturing into food and other delivery business.

As a complement to its transport and delivery services, DiDi has made an effort to market “smart cities” projects across Colombia, leveraging solutions it has implemented in the city of Xi’an and elsewhere in China. Thus far, however, such efforts have been confined to presentations and other marketing efforts, without formal commitments by Colombian municipalities.

Covid-19 Engagement

During the Covid-19 pandemic, the PRC built significant inroads in Colombia by initially becoming its principal vaccine supplier. At the time, the country was having difficulty obtaining vaccines from other sources. It also purchased more than 2,700 ventilators from China. A number of the machines failed, however, leading to the deaths of an unspecified number of patients.

During the pandemic, Colombia purchased 27 million vaccine doses from the Chinese company Sinovac. In March 2021, a year into the pandemic, 76 percent of the vaccines the Colombian government received came from the PRC. While the impact of China’s vaccines has diminished with the broad availability of more effective genetically engineered vaccines from the West, Sinovac is leveraging its entry into the country to establish a broader, more permanent presence for vaccine development and production beyond Covid-19. It has sought partnerships with local Colombian healthcare organizations such as Clínica de la Costa. In June 2022, Sinovac announced plans to build a $100 million vaccine production facility in Bogotá.

Chinese Community

The Chinese community in Colombia is smaller than in other Latin American countries, as symbolized by the lack of a Chinatown in Bogotá and the initial lack of PRC-based companies in the Colombian Chinese Chamber of Investment and Commerce (a situation that has since changed). One knowledgeable source interviewed for this work estimated that the Chinese community has increased from approximately 20,000 a decade ago to 30,000 in 2022 due to entry of Chinese workers hired by PRC-based firms.

Members of the older generation of Chinese in Colombia principally come from the southern coastal part of China and speak Cantonese, to the extent to which they have retained the Chinese language. In addition to residing in Colombia’s principal cities, such as the capital Bogotá and Medellín, many live in coastal areas such as Barranquilla. The small number of newer Chinese migrants, tied to activities by PRC-based firms, tend to come more from northern China and speak Mandarin.

While generally respected, Chinese Colombians are sometimes subject to hostility from people who associate them with the competitive threat of PRC-based companies to Colombia’s traditional economy and producers. The violence noted against ethnic Chinese shop owners in San Victorino exemplifies this.

Intellectual Infrastructure

Colombia’s intellectual infrastructure for doing business with the PRC has expanded significantly in recent years. The Colombian export promotion organization ProColombia (previously called ProExport) has a division focused solely on the PRC, headed by Natalie Tobon, who is well respected for her China knowledge. ProColombia has both a significant office in Beijing and a smaller office in Shanghai. Its new head, Carmen Caballero, named by the Petro administration in early October 2022, is a former diplomat from the same conservative party as Colombian foreign minister Leyva. Caballero is expected to focus on commercial opportunities in the PRC as part of Colombia’s broader commercial and political engagement.

The Colombian Chinese Chamber of Investment and Commerce, which a decade ago had approximately 30 members, has over 140 participants as of 2022, including many Chinese companies. Wu Yu, the head of Colombian operations for CHEC, which has become arguably the most important Chinese company in the country, is the vice president of the chamber. The chamber is planning to open a business office in Shanghai.

The Colombian Chinese Chamber of Investment and Commerce, which a decade ago had approximately 30 members, has over 140 participants as of 2022, including many Chinese companies.

In education, the number of Colombian Confucian institutions, sanctioned by the PRC for teaching the Mandarin language, Chinese characters, and Chinese culture, (EAFIT University in Medellín and University of the Andes, or Uniandes, and Jorge Tadeo Lozano University in Bogotá) has not expanded for a decade. Nonetheless, according to Colombian experts familiar with the matter, the number of annual scholarships awarded through those institutes, universities in the PRC, and programs affiliated with the Chinese government has expanded from 20 per year in 2012 to approximately 70 in 2021. In addition, various PRC-affiliated Confucius classrooms exist at the high school level, and other projects in the works could blossom during the Petro administration.

Beyond official PRC-sanctioned education and culture programs, several leading Colombian universities and well-known professors teach courses about the PRC. These include the respected Externado University in Bogotá, Uniandes, and Pontificia Universidad Javeriana. Still, no Colombian university has a dedicated China studies program. In the case of EAFIT University in Medellín, the university chose to separate the PRC-focused courses of the Confucius Institute it hosts from the courses on other parts of Asia by its well-respected Asia Pacific Studies Center. According to those consulted for this work, the decision was driven, in part, by concerns from non-Chinese Asian governments and business partners working with the center regarding the role of the PRC government with EAFIT’s Confucius Institute.

In political and cultural affairs, the China-Colombia Friendship Association conducts activities for the promotion of Chinese culture and friendly relations with the PRC. It reportedly maintains regular interactions with the PRC embassy in Colombia. Its leadership comprises well-respected Colombian business and political elites, including former Supreme Court judge Guillermo Poyan, former ambassador to China Jose María (Pepe) Gómez Osorio, and Lina Maria Luna, one of the best-known among Colombia’s new generation of young sinologists.

Although the China-Colombia Friendship Association does not play a significant public role in the country’s politics, traditionally such friendship committees have been a vehicle employed by the Chinese Communist Party as part of its United Front activities for promoting goodwill toward the PRC and the party’s political and strategic interests in the region.

At the subnational level, the PRC has also used sister-city relationships, among other vehicles, to build ties and goodwill in Colombia, including providing assistance during the Covid-19 pandemic. Current PRC-Colombia sister-city relationships include those between Fujian Province (China) and the Department of Antioquia (Colombia) and between the cities of Nanjing (China) and Barranquilla (Colombia), Pengzhou (China) and Paipa (Colombia), Tianjin (China) and Cali (Colombia), and Kunming (China) and Armenia (Colombia).

The PRC has also sought to expand its soft power influence in the country, including by inviting Colombian scholars, think tank professionals, and businesspeople on paid trips to participate in academic forums, conduct investigations, receive training, or provide consulting services. In the domain of media affairs, Caracol, a television broadcaster with substantial media presence in Colombia, in 2021 reportedly explored an agreement with China Global Television Network (CGTN), though the agreement did not go forward.

The PRC has also sought to expand its soft power influence in the country, including by inviting Colombian scholars, think tank professionals, and businesspeople on paid trips to participate in academic forums, conduct investigations, receive training, or provide consulting services.

Security Relationships

Despite Colombia’s long-standing close defense ties with the United States, the country has maintained a low-level defense relationship with the PRC. The relationship has included PRC donations of modest quantities of military equipment, which by 2016 included $30.5 million in goods through 11 separate agreements. Gifts from the PRC over the years have included hats and gloves for Colombia’s high-mountain battalions during the Uribe government as well as donations of mobile bridges and two Y-12 medium transport aircraft, given in April 2014. The Chinese aircraft spent several years in service with Satena, the national airline run by the Colombian military to support access to remote parts of the country underserved by traditional airlines, until they were ultimately removed due to concerns over their structural integrity following a weather incident.

The PLA-Colombia military relationship has also included periodic institutional visits, sending small numbers of Colombian personnel to military courses in the PRC, and hosting PLA soldiers at Colombia’s elite Lanceros course for special operations forces at the Tolemaida air base, including two PLA officials who attended the course in December 2015. As of 2016, over 200 Chinese military personnel had received some form of training in Colombia.

The PLA has also maintained a defense attaché in Colombia, and Colombia has reciprocated by sending one to the PRC, though it temporarily ceased doing so at the end of the conservative Duque government. Persons interviewed for this work expected that Colombia’s new left-oriented Petro government would likely expand PRC-Colombian military engagement, constrained during the Duque administration, albeit in a cautious fashion. Resumption of occasional institutional military visits between governments, the sending of a Colombian military attaché to the PRC, or possibly renewed training cooperation, such as receiving PLA members in Tolemaida, could be among likely, if symbolically significant, steps.

Other logical, albeit more extreme, future developments in the Sino-Colombian security relationship include expanded equipment donations or sales to the Colombian military, including electronic surveillance architectures and possibly space cooperation, and PRC-based private security companies protecting Chinese companies and their personnel in Colombia, as has already occurred in Asia.

Conclusion

Although the Petro administration has not focused extensively on Colombia’s relationship with the PRC, that relationship is poised to expand due to multiple factors. These include the substantial human connections and commercial infrastructure of PRC-based firms already in Colombia and a Colombian president who has appointed to the PRC an ideological ambassador with both deep knowledge of and trust from the country and its government. Moreover, the skilled Chinese ambassador to Colombia is already well positioned to look for commercial and other opportunities. Other factors include capable facilitating organizations, such as ProColombia and the Colombian Chinese Chamber of Investment and Commerce, and the Petro government’s need for more revenues, investment, and loan-based financing as Petro’s state-oriented economic proposals increase uncertainty and cause capital flight by Western investors.

However Washington reacts to the likely expansion of PRC commercial and political engagement with Colombia—as well as possible security engagement—it will be important for the Colombian government to manage those relationships through a framework of transparency, rule of law, and strong institutions. It should do so not simply to accommodate the United States but to increase the likelihood that projects involving Chinese companies will be executed successfully and will present enduring benefits for the country. To that end, Colombia’s engagement with the PRC is a microcosm of the broader course of the Petro government. Good planning, management, and oversight—more than inspiring declarations on social media—will be vital to success, whatever direction the president and his Historic Pact government seek to take the country.