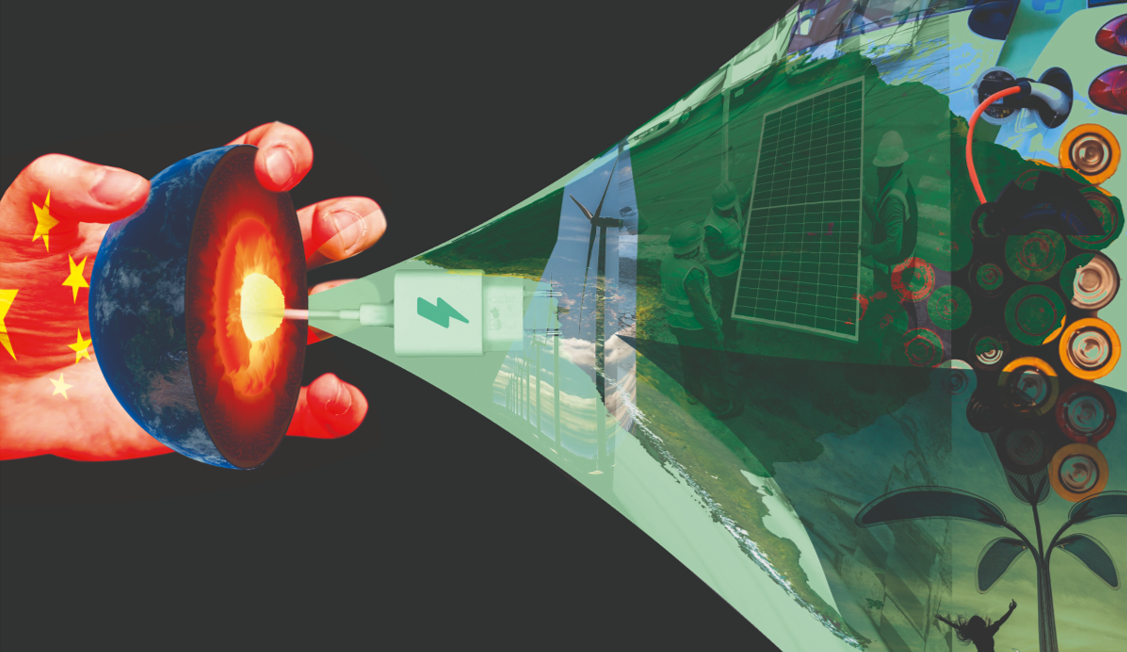

Is China Cornering the Green Energy Transition in Latin America?

A key element of China’s economic advance over the past four decades has been the government’s promotion of its companies’ acquisition of capabilities and market share in sectors seen as strategically important to the country. In recent years, that emphasis has increasingly focused on digital technologies and green energy.

The advance of the People’s Republic of China- (PRC) based firms in telecommunications and other digital sectors has received significant coverage in the press and attention by U.S. policymakers. The equally important advance of PRC-based companies in green energy, however, has received less attention.

In the past decade, in Latin America and elsewhere, PRC-based companies have progressed considerably in sectors critical to the green energy transition, including hydroelectric, solar, wind energy, electric vehicles, electricity storage and transmission, as well as strategic minerals critical to those sectors such as lithium and rare earth elements.

In the last quarter of 2023, BYD surpassed Tesla for the first time in sales of electric vehicles globally.

The PRC has also increasingly included cooperation on green energy in its diplomacy with the region, such as in President Xi Jinping’s April 2023 meeting with Brazil’s Luis Ignacio da Silva.

The strengthening position in these sectors by China-based state-owned enterprises (SOEs) positions the PRC to reap both enormous profits and strategic leverage, as governments across the globe transition from fossil fuels to green energy.

Hydroelectric facilities

In the hydroelectric sector, increasingly during the past two decades, PRC-based construction companies oriented toward large-scale projects, supported by banking partners willing to back their overseas ventures, and sympathetic Latin American partners, have built a significant portion of the region’s new hydroelectric facilities, albeit with significant quality, social, and environmental problems.

In Ecuador, the populist socialist regime of Rafael Correa contracted PRC-based companies to build six major hydroelectric facilities during his tenure (2007-2017): Coca Coda Sinclair, Toachi-Pilaton, Minas San Francisco, Termoesmereldas II, Delsitanisagua, Mazar Dudas, and Quijos. Virtually all of the projects experienced major problems; the Ecuadoran government fined China Water and Electric $3.25 million on Toachi-Pilaton, and ultimately took the project away from it, as well has taking the Quijos project away from China National Electric Equipment Corporation, both for poor performance. Ecuador’s largest PRC-built hydroelectric facility, Coca Coda Sinclair, was so badly planned and executed that the structure caused massive erosion and the rerouting of the Coca river that fed it, plus over 17,000 structural cracks that prevent the significant over-budget $3.3 billion facility from being operated at even half its 1.5 GW design capacity.

In Bolivia, the leftist populist government of Evo Morales contracted PRC-based companies to build three hydroelectric projects: the $1 billion 400 MW Rositas facility in Santa Cruz, financed by China Export-Import bank and built by China Water and Electric corporation; the $442 million 120 MW Misicuni facility in Cochabamba, by China’s CAMCE; and the $140 million 55 MW San Jose facility, completed by Sinohydro in 2018. As in Ecuador, however, all three Chinese hydroelectric projects in Bolivia experienced significant delays, and inspired protests by both workers and affected communities.

In Honduras, even prior to the establishment of diplomatic relations, PRC-based companies were contracted to build two hydroelectric projects. The $347 million Patuca III facility was completed by the Chinese firm Sinohydro, following significant delays due to protests and criminal violence. Sinohydro also was contracted to build, but eventually abandoned construction of the Aqua Zarca facility. Following Honduras’ diplomatic recognition of the PRC in March 2023, the government of Xiomara Castro is negotiating PRC construction and funding of a new hydroelectric facility, the 150 MW Patuca II.

In Argentina, in 2013, the leftist Peronist government of Christina Fernandez contracted the PRC-based Ghezouba Group, with funding from China Development Bank, in a $4.7 billion project for two hydroelectric facilities on the Santa Cruz river, the Nestor Kirchner and Jose Copernic facilities. When center-right President Maurico Macri came to office in December 2015, he suspended the project over environmental and other issues, but was persuaded to continue the projects, in part due to “cross-default” clauses built into the contract that would have enabled the PRC to call in loans for other China-funded projects important to the government, had the hydroelectric project been cancelled.

In Guyana, the Amaila Falls hydroelectric project, to be built by the PRC-based firm China Railway First Group, and principally funded by China Development Bank, was cancelled after the New York-based system integrator Sythe Global, pulled out of the project in late 2013. The project resurrected shortly after the People’s Progressive Party (PPP) that had negotiated the original project returned to power in August 2020. In 2022, however, the preferred Chinese builder, China Railway First Group, pulled out of the $700 million project over its inability to comply with the Build-Own-Operate-Transfer (BOOT) structure of the contract, preferred by the Guyanese government.

In Peru, China Three Gorges acquisitions of the South American assets of California-based Sempra Energy gave the later control of the Chaglla hydroelectric facility. Separately, PRC-based companies China Water and Electric and Harbin Electric Machinery corporation played a significant role in the 209.3 MW San Gaban III facility, albeit with significant delays during the COVID-19 pandemic.

In Chile, China’s Southern Power Industrial Corporation (SPIC) acquired five hydroelectric facilities through its 2017 purchase of Pacific Hydro. PRC-based firms also pursued a role in the Hidroaysen project, involving erecting thousands of miles of power lines across environmentally sensitive areas, connecting dams to be built in the far south of Chile to users in the central part of the country. In the end, the project was cancelled for environmental reasons.

In Brazil, in 2016, China Three Gorges acquired eight hydroelectric facilities through the $1.2 billion acquisition of Duke Energy.

In Colombia, China’s Sinohydro bid unsuccessfully for the Hydroituango facility in the department of Antioquia, but returned in December 2022 with Power China and a relatively unknown Chinese firm, “Yellow River,” as the sole bidder to complete the project that had been taken away from the Colombian consortium to which it had been awarded.

Solar energy

In the solar energy sector, PRC-based companies, leveraging funding from Chinese banking partners and low-cost photovoltaic panels from Chinese suppliers, have had a role as builder or supplier to an estimated 90 percent of new wind farms and solar parks in the region.

China-built solar parks include two of the biggest in the region, the 300 MW Cachari, being built in the Jujuy province of Argentina by Power China and funded by China Export-Import bank, and the 1.1 GW multi-phase Açu project in Rio de Janeiro, Brazil, to be built by China Machinery Engineering Corporation.

In addition to construction and finance, PRC-based companies are the principal suppliers of photovoltaic panels to solar projects in the region. Among Latin America’s largest solar parks, the 828 MW Villanueva park in Sonora, Mexico and the 292 MW Nova Olinda solar park in Piaui, Brazil, both got their solar panels from PRC-based Jinko Solar. Similarly, the 405 GW Puerto Libertad project in Sonora, Mexico acquired its solar panels from PRC-based JA Solar.

Beyond powerplants, the increasing dominance by PRC-based suppliers of the solar panel industry means that a disproportionate share of small-scale solar projects for homes and businesses in the region directly or indirectly benefit the PRC.

Wind energy

In the wind energy sector, as in solar energy, PRC-based companies leveraging Chinese banking partners, and using low-cost turbines and other equipment whose technology has largely been appropriated from European partners, play a major role in new wind farms.

Significant wind power projects by PRC-based companies include China Goldwind’s participation in the 102.4 MW Loma Blanca and the 98.6 MW Mirimar wind farms in Argentina, and in the 76.5 MW phase one of the Villonaco wind farm in Loja, Ecuador, although Goldwind did not play a similar role in the subsequent phases of Villonaco.

China’s Goldwind also supplied turbines to the 55MW Penonomé I wind farm in Panama in 2014, but divested its interest in the project to Spain’s AES in 2020.

Hydrochina has a role in the planned 300MW Cerro Policia wind farm in Rio Negro Argentina.

As in the hydroelectric sector, PRC-based companies have also acquired wind power assets in the region built by other companies. China SPIC’s November 2020 acquisition of Zuma Energy gave the company control over windfarms in four Mexican states including a 424 MW wind farm in Reynosa, the largest in the country. Similarly in Brazil, in 2019, China CGN Energy International Holdings acquired interest in the 716 MW Lagoa dos Ventos wind farm through its acquisition from Enel Green Power Brasil Participações.

Electric vehicles

In the electric vehicle (EV) sector, PRC-based companies play an increasingly dominant role in both public transportation, and private vehicles.

With respect to public transportation, PRC-based companies have sold more than 4,130 electric busses to Latin America, including Chinese brands BYD, Foton, Yutong, Sunwin, Kinglong, and Zhongtong.

As of February 2024, Chile alone had more than 2,043 electric busses, all but 30 of which are Chinese, including brands BYD, Yutong, and Kinglong. Metropolitan Santiago, with over 1,000 Chinese electric busses, has more than in any other city outside of the PRC. Ironically, the high price of the vehicles was reportedly one factor obliging the Santiago government to raise bus fares, contributing to social protests in the country in the fall of 2019.

In Colombia, 100 percent of the 1,590 electric busses operating in the country, are Chinese, mostly of the brand BYD, although the country also uses some Chinese Sunwin and Yutong electric busses.

In Uruguay, 31 of the 36 electric busses operating in the country are Chinese, from the manufacturers BYD and Yutong.

In Mexico City, at least 328 of 654 electric busses operating in the country are Chinese.

Of the largest countries in Latin America, only in Brazil, with local electric bus company Eletra, has the penetration of Chinese electric busses been more limited, with the sole Chinese brand in Brazil, BYD, having sold only 73 of the 444 electric busses in the country.

With respect to other types of EVs, PRC-based companies, led by BYD, are capturing a rapidly expanding share of a rapidly growing market. EV sales in Latin America grew by 91 percent from 2022 to 2023, to 94,000 vehicles, of which BYD (with almost no electric vehicle sales in the region just two years prior), sold 18,000 units. By 2030, the region is expected to buy 1 million EVs per year, creating an important opportunity for Chinese EV brands there.

BYD is building EV manufacturing and operating infrastructure across the region. In October 2023, it announced that it would take over a facility vacated by U.S. auto manufacturer Ford in Camaçari, in the Brazilian state of Bahia, to build electric vehicles there for the Brazilian and broader Mercosur markets. In Brazil BYD is also teamed with the Brazilian firm Raizen to build a network of 600 charging stations in eight major cities, seeking to capture 25 percent of the Brazilian charging station market.

In addition to selling more units, PRC-based companies in the EV market are also enveloping their competitors through participation in competitor supply chains. A significant number of Tesla’s suppliers are PRC-based. The situation led Tesla to invite its Chinese suppliers to build new operations in Nuevo Leon, Mexico where it is building its new EV Gigafactory.

Electricity storage

PRC-based companies are not only key suppliers of batteries for EVs in Latin America and globally, they are also increasingly key suppliers of other largescale electric storage devices for commercial, government and private operations. In the Dominican Republic, for example, the electricity portion of the Chinese company Huawei, is a key supplier of industrial batteries and inverters.

PRC-based companies are also positioned to dominate next-generation battery technology, such as sodium.

Electricity transmission

As a complement to the expanded PRC role in green energy in the region, PRC-based companies play an increasingly significant role in the electricity transmission and distribution systems of region.

In Brazil, beginning with China State Grid’s 2010 $989 million purchase of seven transmission assets, at least 14 PRC-based electricity companies are now operating in the country, with a cumulative investment of at least $36.5 billion. Some experts worry that PRC-based companies under the China-sympathetic Lula government are exploiting their relationships within the country to structure bids which they are favored to win.

In Chile’s private-sector dominated electricity market, through five major acquisitions over five years, PRC-based companies now control at least 57 percent of power distribution in the country. Current plans by China Southern Power Grid to increase its share of Chilean electricity distributor Transelec from 28 percent to 70 percent could increase that figure even further.

In Peru, the government’s potential authorization of China Southern Power Grid’s purchase of ENEL Peru, would PRC-based companies virtually 100 percent of electricity distribution in the greater Lima metropolitan area.

PRC-based companies have further bid on important electricity infrastructure projects in a range of other countries throughout Latin America. These include work to upgrade the electricity grid of Buenos Aires, a China Machinery Engineering Corporation project to complete a 500 MW power distribution and transformation ring in Uruguay, and work by China National Electronics Import and Export Corporation (CEIEC) on Georgetown, Guyana’s electrical grid.

Lithium and rare earth minerals

With respect to lithium and rare earth metals, critical to produce renewable energy technologies, including batteries and electric vehicles, as well as advanced military equipment, PRC-based companies not only operate an important portion of the sites where such minerals are mined, but also control its processing and transformation into intermediate products such as lithium-ion batteries.

In Chile, in December 2018, the PRC-based firm Tianqi acquired a 24 percent stake in Sociedad Química y Minera (SQM), one of the country’s two lithium mining consortiums. In June 2023, Chinese car company BYD announced plans for a $290 plant to process lithium into battery components, near the mining sites in the Antofagasta region of northern Chile.

In Bolivia, which has the world’s largest reserves of lithium, a consortium led by China’s Contemporary Amperex Technology Company (CATL), signed a $1.4 billion agreement with the government in 2023 to mine lithium from the Uyuni and Oruro salt flats. In June 2023, China’s CITIC Gouan signed its own $857 million agreement with the government for a lithium extraction facility, with the possibility of later investing in a lithium-ion battery production plant in the country. Activities by PRC-based companies in Bolivia’s lithium sector also includes smaller projects such as a pilot plant by Xinjian TBEA.

In Argentina, which has more decentralized, pro-market orientation to lithium mining with approvals principally managed at the provincial level, PRC-based companies are active in multiple projects across multiple provinces. These include the Cauchari-Olaroz project in Jujuy province, operated by China’s Ganfeng in conjunction with Canadian partner Lithium Americas. It also includes, Lithea, which Ganfeng acquired in 2022 from Argentina’s Pluspetrol for $962 million, with two lithium operations in the province of Salta, and Minera Exar, in which Ganfeng is also the majority stakeholder. In addition’s China’s Zijin operates the Tres Quebradas lithium field in Cajamarca, and is exploring investment in a facility to produce lithium ion battery cathodes there. Beyond these, PRC-based carmaker Chery and Chinese partner Gotion are reportedly negotiating with the government of Jujuy to build a $400 million electric vehicle facility there, that would use lithium from the province.

In Mexico’s Sonora desert, Bacanora, the country’s major lithium field, was acquired in 2021 by PRC-based Ganfeng for $391 million. In April 2022, the Mexican government’s introduction of legislation and other moves to nationalize the sector led Ganfeng to suspend its activities to develop the fields, leading the government, in November 2023, to revoke the company’s licenses to do so.

Despite such setbacks, the EV manufacturer Tesla plans to obtain its lithium-ion batteries from local sources, positioning the Chinese to be the key supplier once disagreements with the government are resolved.

Beyond lithium, in the rare earth minerals sector, which critical for the production of electric vehicles, smartphones, laptops, healthcare devices, and military equipment, a Chinese investor group led by Baosteel, in 2011, acquired a $1.95 billion 15 percent stake in the mining company CBMM, whose Brazil operations are one of the most important sources of commercially recoverable concentrations of niobium in the planet.

Implications and conclusions

PRC efforts to develop capabilities and market share in green energy, and the efforts of their government to promote them are understandable, given its increasing importance in the context of global warning. Nonetheless, Western companies and the U.S. government should also take note of the PRC advance in green energy sectors for the same reasons.

A global green energy transition in which PRC-based companies dominate the technologies and products that Western governments are moving to at great cost, would greatly accelerate the transfer of wealth from the West to the PRC. It would also give enormous leverage for the PRC stemming from monopoly positions, and would create enormous strategic vulnerabilities for the West in sectors such as defense and space dependent on the technologies.

For Latin America, PRC dominance of green energy sectors and technologies also gives it enormous leverage over the actions and discourse of governments and the private sector. Historically, the PRC has repeatedly used its economic weight to “punish” actors whose statements and actions offend it. Examples include its suspension of purchases of Argentine soybeans in 2010, in the face of protectionism by the Argentine government against Chinese products. The PRC also ceased a broad array of imports from Australia when the later dared to question the origins of the COVID-19 pandemic in Wuhan China. Most recently the PRC suspended a $6.5 billion line of credit to Argentina as the country was navigating a financial crisis, in response to statements and actions by the incoming government of Javier Milei perceived to be hostile to the PRC.

In addition, PRC contracts with Latin America are replete with “cross-default clauses” and other instruments which allow it to threaten governments taking actions objectionable to the PRC in areas far beyond the business covered by the contract. In the context of such past and ongoing behavior, PRC dominance of the principal sources of power and mobility in Latin American economies would give the PRC troubling power to intimidate the region with respect to its discourse and policies relevant to Chinese interests.

It is imperative for Western governments and companies to do more to compete with the PRC in green energy sectors. At the same time, it is also important for Latin American and other governments, acting in their own long-term interests, to use caution in their approval of acquisitions and projects that would give PRC-based companies a monopoly in the sector.

Maintaining a diversity of choice in this increasingly important area is in the long-term interest of the countries of the region.