The Evolution of PRC Engagement with Mexico

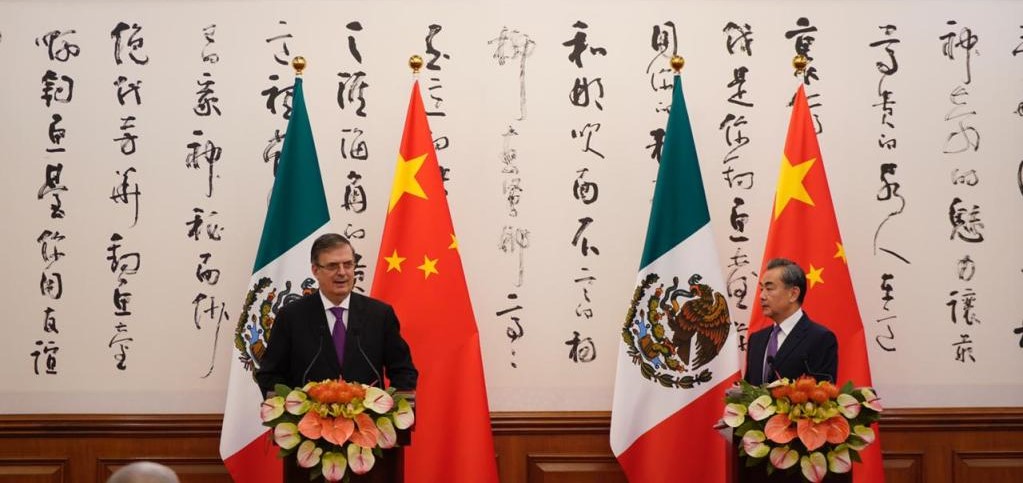

Photo: Mexican Foreign Minister Marcelo Ebrard meets with Chinese Foreign Minister Wang Yi during Ebrard’s visit to Beijing in 2019. Source: Government of Mexico.

This article represents Part II of a two-part series on Mexico. Click here to read Part I.

Overview

Mexico, despite its integration with the economy of the United States, as well as its historic distrust for and structural competition with the People’s Republic of China (PRC), is pursuing policies that are expanding options for that country, causing serious strategic implications for the United States and the region.

Political Orientation

Mexico has always shown strategic ambiguity with respect to the PRC. It was part of the first wave of Latin American countries to establish relations with the PRC, doing so in February 1972. Mexico was also one of the first countries in the region recognized by the PRC as a strategic partner. The Chinese government recognized Mexico as a strategic partner in 2003, and the two governments established a high-level working group the following year. Enrique Pena Nieto, the president of Mexico at the time, met with his Chinese counterpart Xi Jinping three times during a six-month span in 2013, including in June 2013, when the two countries elevated their relationship to a “comprehensive strategic partnership.”

Despite the interest of individual Mexican businesspersons and politicians in profiting from Chinese investment and exports to the Chinese market, Mexico’s overall embrace of the PRC has been limited—mainly due to its integration with the U.S. through the North American Free Trade Agreement (NAFTA), and its close security relationship under the governments of Felipe Calderon and Enrique Pena Nieto. Mexico is currently one of a small group of countries in the Hemisphere that has not signed onto the 2013 PRC “Belt and Road” initiative.

Mexican experts consulted for this work also argue that the relationship was limited by structural competition between Chinese and Mexican industries, such as manufacturing, as well as distrust of the PRC within certain parts of Mexico’s business elite and society. There have also been difficulties within both Mexico’s business community and the Mexican government in understanding and promoting the nation’s interest toward China.

The relationship was also arguably impaired by the PRC’s displeasure with political actions by the Mexican government and its actions on projects displeasing the Communist Chinese government. These included then-President Felipe Calderon’s reception of Tibet’s Dalai Lama in 2011, the cancellation of the Mexico City to Queretaro rapid train project in January 2015, the stoppage of the China-focused “Dragon Mart” retail-wholesale-distribution hub in Quintana Roo in 2015, and the 2016 stoppage of the Chicoasen II hydroelectric project, in which the Chinese company Sinohydro was the principal contractor.

Although Mexico has continued its contradictory posture toward the PRC under the government of President Andres Manuel Lopez Obrador (AMLO), multiple factors have combined to bolster the importance of the PRC for the AMLO government. On one hand, its focus on state-led growth—including its prioritization of a state role in the petroleum, electricity, and mining sectors—have decreased the interest of market-oriented players in Mexico in those sectors. As a result, Chinese loans, tied to work by PRC-based companies, have remained as one of the few remaining options. Indeed, PRC-based companies play a key role in AMLO’s signature infrastructure project, the Maya train, as well as in the lithium, petroleum, electricity, and manufacturing sectors, as discussed in subsequent sections. At the same time, the expanded vulnerability of Mexicans due to the lingering economic effects of COVID-19, the inflationary effects of Russia’s invasion of Ukraine, and lackluster prospects for Mexican GDP growth increase the importance of Chinese demand for Mexican products in sectors such as pork and tequila, where they make such purchases.

The expanding possibilities for the PRC in Mexico under AMLO are reinforced by the country’s Sinophile Foreign Minister Marcelo Ebrard. In his previous role as mayor of Mexico City, Ebrard was one of the first major local-level Latin American officials to travel to the PRC and played a key role in supporting connections between Mexico City-based institutions and businesspersons with the PRC during that time. As Foreign Minister, Ebrard showed his interest in the PRC by traveling to the country in July 2019 to promote expanded economic and other forms of engagement. Ebrard also played a key role in Mexico’s engagement with the PRC in conjunction with the country’s role as President of the Community of Latin American and Caribbean States (CELAC) from 2020-2021, including the December 2021 China-CELAC forum and the associated generation of the 2022-2024 China-CELAC joint action plan.

Patterns of Trade

As with many other countries in Latin America, Mexico’s bilateral trade with the PRC has increased exponentially since the PRC was admitted into the World Trade Organization (WTO) in 2001. Total trade between Mexico and the PRC expanded from USD $7.3 billion dollars in 2002, just after the PRC was admitted into the WTO, to $85.8 billion in 2020, an 11.7-fold expansion.

Mexico has historically run deficits with the PRC. In 2020, its imports from the PRC of $77.9 billion were ten times greater than the $8.0 billion in goods and services that it exported to the country.

It is important to note that Mexico’s trade with the PRC consistently continues to be eclipsed by its trade with the U.S. By comparison to Mexico’s previously-noted $85.8 billion in trade with the PRC in 2020, its trade with the U.S. for the same year was $516.5 billion. Moreover, in contrast to its consistent enormous deficits with the PRC, Mexico has consistently had a surplus with the United States. In 2020, for example, Mexico’s exports of $338.7 billion in goods and services to the US were almost double its $177.8 billion in imports from the country that same year.

Although the aggregate numbers show that the U.S. is both a much more significant and much more beneficial trade partner to Mexico than the PRC, the possibilities of doing business with the PRC continue to capture the attention of certain portions of Mexico’s political and business elites. Such sentiments reflect perceptions of the possibilities stemming from the size of the Chinese market and the resources that its banks and state-owned enterprises (SOEs) can potentially bring to bear as a partner. Despite the broader patterns, such interest also reflects the hopes of individual Mexican businesspersons and other actors of benefitting from particular projects with the PRC.

The subsequent sections examine major Chinese projects in particular sectors of the Mexican economy.

Petroleum

China was a relative latecomer to the Mexican petroleum sector. China National Offshore Oil Company (CNOOC) entered the Mexican market in December 2016 with its purchase of rights to exploit a deep-water block in the Perdido basin, adjacent to U.S. oil fields in the Gulf of Mexico. CNOOC reportedly paid a premium for the rights, illustrating its prioritization of securing a presence in Mexico’s oil sector, then open to private-sector participation under the Peña Nieto government, although the block’s performance has reportedly underwhelmed Chinese expectations.

Just as PRC-based banks offered a $10 billion loan to Brazil’s Petrobras in 2009 when they were pursuing opportunities in that nation’s oil sector, in 2014, the PRC reportedly offered Mexico’s national oil company Pemex a $5 billion line of credit to support its expansion of capabilities. This move reflected the desire of Chinese companies to establish a presence in Mexico’s oil sector. However, the Mexican government never took the PRC up on the offer. In 2020, the PRC offered $600 million to help finance the AMLO government’s signature Dos Bocas refinery, although as with the previous offer, Mexico does not appear to have pursued this offer either. Nonetheless, as the AMLO government continues to push forward with its state-led development of the petroleum sector, the PRC has shown itself to be willing to provide the funding. Up until the writing of this work, Mexico’s need for energy financing under AMLO has not grown sufficiently to agree to China’s often predatory loan terms.

Mining

China’s role in Mexico’s traditional mining sector has historically been relatively limited. In 2009, China’s Jinchuan group committed to invest $600 million in the Bahuerachi mine, located in the southeast region of the Mexican state of Chihuahua. Many of the Chinese projects are, however, small-scale, in areas where irregular mining is commonly tied to other illicit activities. Examples include the 11 small mining sites operated by China Unified Mining Development in the states Guerrero, Michoacan, and Colima. Similarly, the Tianjin-based company Shaanxi Dongling Group also made a modest investment of $3.4 million in the Los Vasitos mine in Sinaloa.

China’s most notable engagement in the Mexican and mining sector is in lithium, where, in 2021, the PRC-based firm Ganfeng spent $264 million to acquire 100% ownership in the Bacanora lithium deposit in Mexico’s Sonora desert. In April 2022, however, the Mexican Congress, dominated by AMLO’s MORENA party, passed a bill nationalizing the lithium sector and announced plans to review existing contracts, putting the status of the just-made acquisition by Ganfeng in question. In June, however, AMLO appeared to reverse his actions, declaring that previously granted lithium contracts “would be respected,” effectively ceding to Chinese pressure and negating the point of his nationalization of the sector.

Electricity

In electricity generation, Chinese progress has been mixed. Work on the $414 million, 240-megawatt Chicoasen II hydroelectric facility, awarded to a Chinese contractor Sinohydro, was halted in 2016 due to a labor dispute. Nonetheless, in 2020, the AMLO government announced that the plant would be completed, the only hydroelectric facility in Chiapas state. It is currently planned to begin operating in 2025.

Beyond Chicoasen II, in November 2020, the China State Power Investment Corporation (SPIC) acquired Mexico’s largest private renewable energy producer, Zuma. The Zuma acquisition gave SPIC a substantial presence in operating wind and solar power facilities across Mexico. The acquisition was surprising, mainly because it occurred at a time in which the AMLO government was publicly and controversially advancing policies and a law to prioritize electricity generation by the state entity Corporacion Federal de Electricidad (CFE).The AMLO government was also downplaying the value of renewable energy generation and blocking other firms from operating renewable electricity plants. Since the acquisition by SPIC, Zuma has maintained a relatively low profile. It is not clear whether, like Ganfeng in the lithium sector, Zuma hopes to use broader PRC leverage as a market and source of loans and investments, specifically to secure an exception for Zuma from AMLO’s broader plans to favor the state entity CFE over U.S., Canadian, and other private sector electricity providers.

Manufacturing

The Chinese have long had a small but important position in the Mexican manufacturing sector, partially oriented towards accessing the U.S. market through Mexico’s trade integration with it under NAFTA and subsequently through USMCA. Early investments from PRC-base firms include the construction of a garment factory by Sinatex in Ciudad Obregon, investment by Golden Dragon Precise Copper Tube Group in a plant in Coahuila for manufacturing copper tubes, and a computer manufacturing plant in Monterrey by the Chinese firm Lenovo, the firm’s largest factory in North America.

In the automotive sector, the Chinese company FOTON established a component manufacturing facility in Veracruz. PRC-based FAW began work on a final assembly auto factory in Michoacan, although the venture in the end did not prove viable. Other Chinese automakers FOTON, BAIC, JAC, Chang’an, and BYD are all present in the Mexican market. In 2020, BYD announced a contract to supply 1,000 electric taxis to the Mexican market. Chinese bus manufacturers, including Yutong, are also selling products to Mexico City and other Mexican municipalities.

Despite such advances, PRC-based manufacturers have been looked upon with suspicion by their Mexican competitors. As noted previously, in 2015, a large-scale project by Mexican businessman Carlos Castillo to set up a China-oriented retail wholesale distribution hub in Quintana Roo, called Dragon Mart, was stopped following an extended series of legal battles concentrating on its alleged environmental and other impacts.

Transportation Infrastructure

China’s role in Mexican infrastructure projects, previously characterized by high profile failures such as the cancelled Mexico City-Queretaro high speed train, has begun to take on new life under AMLO.

Presently, the Chinese company China Communications and Construction Corporation (CCCC) is a key partner in AMLO’s signature project to develop the south of Mexico, specifically through the $7.4 billion, 1,500 kilometer Maya train project. Not only did CCCC win the contract for the first segment of the project, but its partner Mota Engil is 30 percent owned by CCCC.

Beyond the Maya train, in November 2020, PRC based China Railway Road Corporation Zuzhou won a $1.6 billion contract for the renovation of Line One of the Mexico City Metro, and is reportedly also interested in bidding for a $29.4 million contract to supply rail cars to the line.

Telecommunications

In telecommunication, the Chinese company Huawei has operated in Mexico since the early 2000s, alongside its smaller PRC-based counterpart ZTE. Not only does Huawei have a strong position in the Mexican smartphone market, but 80 percent of Mexican telecommunication infrastructure currently is reportedly supplied by Huawei, including its role in Mexico’s 4G “shared network” project, begun in 2013. Mexican billionaire Carlos Slim, and his company America Movil reportedly work closely, although not exclusively, with Huawei. Huawei is also currently conducting pilot projects for the deployment of 5G in Mexico, and is reportedly strongly positioned to take a leading role in 5G in the country as it is rolled out.

Other Digital Technologies

Beyond telecommunication, Huawei is building substantial cloud computing capacity in Mexico, targeting new technology-oriented and other Mexican small businesses to provide services to.

In the surveillance technology industry, in 2021, the PRC-based company Hikvision acquired a major stake in Syscom, Mexico’s largest surveillance system company.

The PRC-based ride sharing company Didi Chuxing entered the Mexican market in 2018 and is growing strongly there. Indeed, Mexico and Brazil are the two countries in which the Chinese company has most successfully expanded its presence in Latin America during the pandemic.

Finance

In traditional banking, Bank of China, HSBC, ICBC, and other institutions are well established in Mexico. With the exception of HSBC, which is one of Mexico’s most important financial institutions, the activities of PRC-based banks in the country are concentrated on supporting Chinese clients operating in the country, as well as Mexican companies wishing to do business in the PRC, where the relationships of PRC-based banks in China give them a comparative advantage. In addition, the Chinese electronic payment system UnionPay is also broadly available in Mexico.

Although Mexico has a burgeoning non-traditional financial sector, the role of PRC-based firms in the sector has been relatively limited by comparison to their growing presence in Brazil, where Alibaba acquired a $200 million stake in Nubank in 2018.

Beyond the commercial and political influence that comes from China’s growing commercial presence in, and ties with Mexico, the operation of cartels and other transnational criminal organizations in Mexico creates an additional problem. Chinese criminal entities in Mexico and the PRC play an increasingly important role in helping Mexico-based criminal organizations to launder their proceeds in ways difficult to monitor for Western authorities. To this end, the expanding array of legitimate transactions and accounts by Mexico-based entities in PRC-owned banks in the country expands options for criminal organizations, which launder their money in accounts in the PRC, to gain access to those funds in Mexico.

Intellectual Infrastructure

Although the effectiveness of the Mexican government and business elites in engaging with China has been subject to criticism, the country has one of the most developed intellectual infrastructures in the region for studying and engaging with the PRC. This includes five PRC-sponsored Confucius Institutes across the country (two in Mexico City, and one each in Nuevo Leon, Yucatan, and Chihuahua). Mexico also has multiple private and public universities with Chinese studies programs, including Mexico’s National Autonomous University (UNAM), whose China studies center CECHIMEX is arguably one of the most capable such institutions in Latin America. Such intellectual infrastructure contributes to a cadre of Mexican diplomats and businesspersons with capabilities in Chinese language, politics, and business, but not necessarily effective business initiatives or policy which optimally serves Mexico’s national interests.

Conclusion

Over the last two decades, as the PRC has expanded its economic and political engagement in Latin America and the Caribbean, Mexico has represented a bulwark against that expansion. The progress that the PRC and its companies are beginning to make under the AMLO government with respect to Mexican infrastructure projects, the digital sector, and other areas of the Mexican economy has significant strategic implications for Mexico, the United States, and the region.

As illustrated in this work, AMLO’s increasing need for the PRC and its resources is already manifesting itself in subtle compromises that his administration has made towards Chinese companies with respect to lithium, and possibly electricity generation, among other areas. While Mexico’s linkages to the United States in terms of trade, investment, geography, and family are far greater than Mexico’s ties to the PRC, the government’s increasingly complicated economic and fiscal situation—driven in part by the populist orientation of the AMLO government—as well as the hopes and perceptions of Mexican businesspersons, should not be underestimated. A Mexico whose economic and political elites are significantly penetrated by the PRC, and whose political orientation is swayed by that leverage, would have cascading effects with respect to facilitating China’s advance in other parts of the Hemisphere as well, particularly Central America and the Caribbean, where Mexico has had some historical influence. Such an advance would significantly complicate the position of the United States in its own near abroad, particularly as the rest of the Hemisphere increases its engagement with China and its need to work with it. The result could likely be an unprecedented wave of political transitions and economic and fiscal crises that push the region in a direction ever less disposed to cooperate closely with the United States.